Introduction

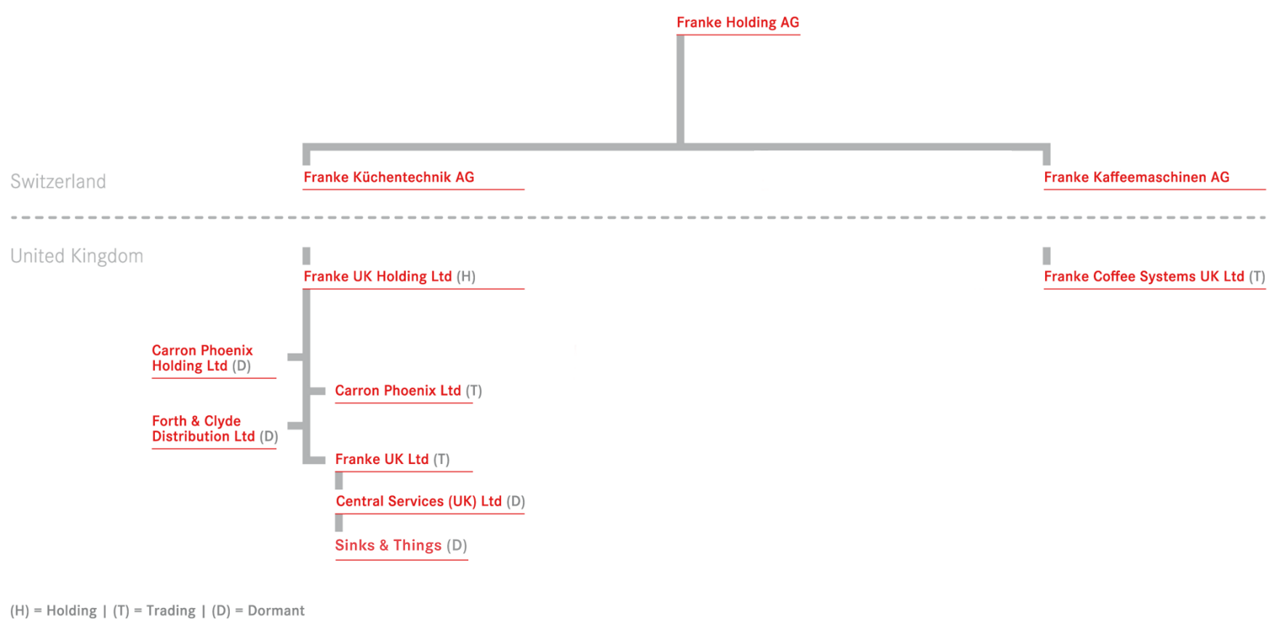

In order to fulfil responsibilities under Schedule 19 of the Finance Act 2016, this paper sets out the tax strategy of Franke-Group and especially its UK subsidiaries (the “Franke UK Group”).

This tax strategy applies to all UK taxes applicable to the Franke UK Group and the document is owned by the Group CFO and the Head of Global Tax. It will be reviewed periodically when there is a change in circumstances, updated as appropriate where necessary and approved by the Group CFO. The Global Head of Tax is responsible for setting and monitoring the strategy. The local Finance Managers of the Franke UK Group are accountable to the Group CFO and the Board of Directors for the implementation of the tax strategy and the management of tax and related risk.

Governance

Responsibility for the tax strategy, the supporting governance framework and management of tax risk ultimately sits with the Group Chief Financial Officer (CFO). Day-to-day responsibility sits with the Group Head of Global Tax, who reports to the CFO and is supported by tax professionals, local Finance Managers and – if deemed necessary – external advisors.

Group tax function

Group Tax is made up of a team of professionals who oversee local finance managers in tax matters, discuss and challenge their tax positions during regular tax calls/meetings and advise/support the local teams on tax-related items. Internal controls and escalation procedures are put in place with the aim of identifying, quantifying and managing key risks.

Management of tax risk

As a large multi-national organization, the Franke Group is exposed to a variety of tax risks that can be grouped as follows:

- Transactional risks, in case that transactions are carried out or actions are taken without appropriate consideration of the potential tax consequences or where advice is not properly implemented.

- Tax reporting and compliance risks such as late filing of tax returns, filing of inaccurate tax returns, failure to submit claims and elections on time, etc. Furthermore, internal systems and processes might not be sufficient to fulfil all necessary tax compliance and reporting requirements.

- Reputational risk as certain tax risks or in some rare cases even allowed tax practices may have an impact on our relationships with our stakeholders, including shareholders, clients, tax authorities and the general public.

Reasonable care and materiality is applied to the Franke UK Group’s on-going approach to UK tax risk management and governance. Tax risks are managed in a similar way to any area of risk across the Group. Local Finance Managers will usually take the lead role in identifying, managing and monitoring tax risks. Several Group functions, such as Group Tax, Group Controlling and Group Internal Audit, ensure that the local responsibilities are taken care of in an appropriate manner.

Where appropriate, we look to engage with tax authorities to disclose and resolve issues, risks and uncertain tax positions. The subjective nature of many tax rules does however mean that it is often impossible to mitigate all known tax risks. In some situations, an acceptable tax risk may be maintained, where we believe our approach is consistent with the principles set out in our tax strategy and where the range of potential outcomes is within acceptable limits for Franke UK Group.

Tax compliance and relationship with tax authorities

We want to comply with our tax reporting, compliance and payment duties on a global level. We engage with tax authorities, including HMRC, with integrity, honesty, fairness and respect to enable a spirit of co-operative compliance.

From time to time, our views (or those of our advisors) on the proper tax treatment in a specific case at hand may vary from those of the involved tax authorities. In such a case, we will work proactively with the concerned tax authorities to achieve an early resolution.

The Franke Group does not have an appetite for tax risk, and moreover holds a desire to achieve certainty in its tax affairs.

Tax planning

We recognise that we have responsibility to pay the correct amount of tax in each jurisdictions in which we operate. The Franke UK Group will especially not engage in artificial transactions the sole purpose of which is to reduce UK tax. However, the Franke UK Group will structure existing commercial arrangements in a tax efficient manner, providing this complies with the UK tax rules and is aligned to the Franke UK Group’s commercial objectives.

We may utilise tax incentives for obtaining tax efficiencies if these are aligned with the local rules related to the incentives and the business and/or operational objectives of Franke UK Group, and if these are not considered to carry significant reputational risk or significant risk of damaging our relationship with the tax authorities in the jurisdictions in which we operate.

In some cases we will seek for external advice in relation to tax planning or other tax areas of complexity or uncertainty to support the Franke UK Group in implementing its tax strategy.

Version Information

This paper sets out the tax strategy of Franke-Group and especially its UK subsidiaries (the “Franke UK Group”). This strategy was published on 01 November 2021 and subsequently reviewed in 2024 with the Group regarding this publication as complying with its duty under paragraph 16(2) Schedule 19 FA 2016 in its financial year ended 31 December 2024. This strategy applies from the date of its publication until it is superseded.